LONDON — Who is Sir Ronald Cohen and why should you care? To answer the first part of that question it might be useful to start with someone else – the person he is most often compared to and the original « Father of Venture Capital. » Answering the second part involves asking more difficult questions, such as what is the monetary value of a human life?

After World War II, the U.S. Military promoted George Frederic Doriot to the rank of Brigadier General and awarded him the highest award it gives to noncombatants for his notable development of venture capitalism, a concept that would revolutionize a key part of the emerging superpower’s war machine.

As part of the U.S. Army’s Military Planning Division, Doriot is credited with bringing scientifically-driven innovation to its R&D unit. So successful were his methods that, in addition to being tapped by U.S. Army Chief of Staff General Dwight D. Eisenhower to lead a « new » Department of Research and Development at war’s end, Doriot was also given a French Legion of Honor and decorated as a Commander of the British Empire.

The French émigré demurred and turned down the future president’s offer, reportedly to return to Harvard Business School where he had maintained an appointment since 1926. However, the famous professor had a different answer for a virtually identical proposal from a crew comprised of MIT President Karl Compton, Vermont Senator Ralph Flanders, Harvard Business School Dean Donald K. David, and financier Merrill Griswold.

The group of men recruited Doriot to head their pioneering venture capital start-up, American Research and Development Corporation (ARDC). Post-war economists derided the very concept of a venture capital company and one even told Doriot personally that it would go bust within a year.

Perhaps unaware of his unofficial ties to Washington, they turned out to be wrong in their predictions and in the span of the three decades Doriot ran the firm, ARDC opened the floodgates for the most predatory form of capitalism the world had ever seen. It was nothing less than the start of what Eisenhower himself would warn Americans about in his farewell address more than ten years later.

After usurping Doriot’s title as the « father of [British] venture capital » for a time, the professor’s protégé has come into his own as the father of social investment, using all the tricks his Harvard Business School teacher imparted. Of the didactic maxims attributed to Doriot, perhaps none other fits Sir Ronald Cohen better than « An auditor is like a tailor; he can make a fat man look thinner or taller or younger. »

Exodus

« Military industrial complex » was a succinct way of phrasing the de facto merger of the academic, federal, and military spheres of the United States in a parallel economy that would fuel the war-driven technological boom of the following decades. It was Doriot, through ARDC and in his legendary course at Harvard called « Machinery,” who spread the gospel of venture capitalism and cemented it as a permanent feature of the American financial landscape.

Silicon Valley is today the center of the venture capital universe and many of the same academic, federal, and military associations remain in place. It is where the Pentagon and its partners joined to create the Internet and all the other military technology that is presently seeping into mainstream civilian society through social media, augmented reality, and artificial intelligence.

Nevertheless, there are few other similarities between their respective life journeys besides being born into money. Ronald Mourad Cohen was delivered in an Egyptian hospital, the son of a Syrian banker and an English mother. The 1956 Suez crisis jettisoned the family from the ancient city, settling in London when Ronnie was just 11 years of age.

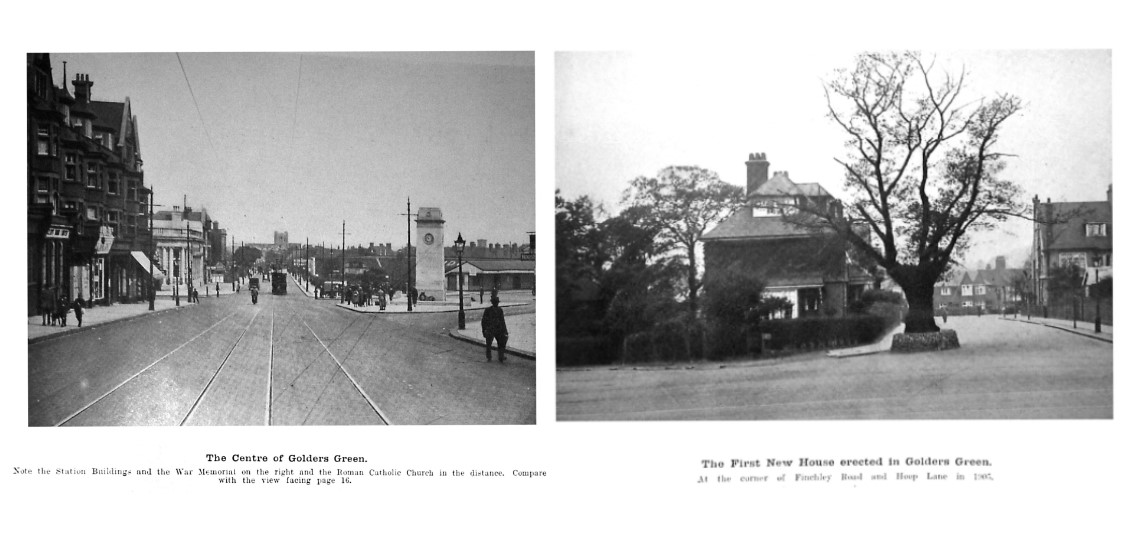

Many online biographies make much of the Cohen family’s ‘refugee’ status at this time. Details are scarce, but we know they settled in London’s Jewish Quarter in a northern suburb of the city called Golders Green with a unique and little-known history that is intimately tied to the role Ronald Cohen is currently playing on the world stage.

Birth of the Smart City

At the turn of the twentieth century, Golders Green in the northwest corner of London became the experimental ground for leading financial institutions, city planners, and self-appointed social theorists of the day, who employed new urban design schemes based on the ideas of social reformist Ebenezer Howard and his « garden city movement. »

Howard’s work has been touted as a « model for an ecologically sustainable society » and his notions about reorganizing the « social world » around nature-integrated cities are considered seminal in the world of urban planning. The less talked about aspect of Howard’s vision revolves around the organization of society itself in his population-capped urban utopia.

Social reform, in Howard’s view, consisted of merging capitalism and socialism to produce the ideal society. Fellow social reformists like Samuel Barnett, his wife Henrietta, and « social administration » pioneer Charles Booth all saw the opportunity to put their ideas of « practicable socialism » to the test by creating a variation on Howard’s vision in Golders Green with the paupers of the decrepit East End of London in mind.

By the time the Cohens arrived, the Jewish community had grown to a quarter of the suburb’s population, in large part as a result of the influx of German Ashkenazi Jews who had fled Nazism. But young Ronald had been born three months after the war ended and was unencumbered by the weight of the past.

Aside from some tense moments during the Second Arab-Israeli War that forced the Cohens to England, Ronnie would soon start excelling at the best schools in the city, eventually landing in Massachusetts with Doriot and catapulting himself into a lucrative career in venture capital where he was welcomed into elite financier and government circles.

Information is power

« Cohen will go where the power is. »

The blunt testimonial was given to The Guardian by a City (of London) associate in 2007 when Sir Ronald Cohen published a « personal manifesto-cum-business autobiography » titled “The Second Bounce of the Ball: Turning Risk into Opportunity.”

Two years earlier, Cohen’s remarkably prescient push to turn his venture capital firm, Apax Partners, into a hedge fund hadn’t sat well with his board of directors, who considered the move too risky. But Cohen had been running with the world’s biggest hedge funds for some time, partnering with Blackstone, KKR, Carlyle Group and others in numerous mergers and acquisitions throughout the early 2000s.

During this period, Apax Partners LLP began a furious buyout of media companies, acquiring « specialty press » assets around the world. Important publications like Vidal, Daily Physician, The Daily Pharmacist and Decision Health, among others in the technical and medical publication sector, were bought up in a massive media restructuring operation that kicked into high gear while coverage of the September 11 attacks was still reverberating in the news.

In November 2001, Cohen was staking out his position in a deal with French private equity firm Cinven and The Carlyle Group to acquire the « No. 1 provider of consumer health-care information in the U.S. » from the Vivendi corporation. The French media giant’s technical and medical publishing unit had been purchased only a few years earlier as part of its 1998 takeover of Havas SA, which owned San Francisco-based Staywell Co., a provider of « information materials, programs, and services to health-care professionals, » as well as « the exclusive publisher of educational and training materials for the American Red Cross. »

Cohen’s deal closed 12 days before the Twin Towers in New York collapsed on their own footprint. After the acquisition, all of Cohen’s medical and technical publication assets were merged into MediMedia USA and quickly sold off in 2003 to London-based B2B media conglomerate United Business Media, now part of Informa.

Informa CEO Stephen A. Carter is the architect of Britain’s Digital Economy Act of 2010 (which established the first comprehensive digital policy framework for the U.K.) and founded the U.K.’s media and communications regulator Ofcom, serving as chief of strategy for then-Prime Minister Gordon Brown and as his minister for telecommunications and media.

Brown’s administration lasted only three years, from 2007 to 2010. But, they were three very significant ones for the global financial sector, as it morphed into the hedge fund-driven monster it is today. Cohen knew which way the wind was blowing when he tried to tweak Apax’s mission in 2005 and it is attributable to such uncanny discernment that Brown considered no one’s counsel more important than that offered by Sir Ronald Cohen.

Bond, Social Bond

For the next decade, culminating with Brown’s years as head of government, the two worked closely together in order to establish policy around social finance, also known as « socially responsible investing, » and create vehicles for the sector’s development — like Big Society Capital (BSC), the world’s first « social investment bank, » co-founded by Cohen, who had been on Brown’s Social Investment Task Force since 2000.

After Brown’s victory, Cohen started a non-profit consultancy called Social Finance and began work on the first « social impact bond » (SIB) run by the U.K. Ministry of Justice and his new organization.

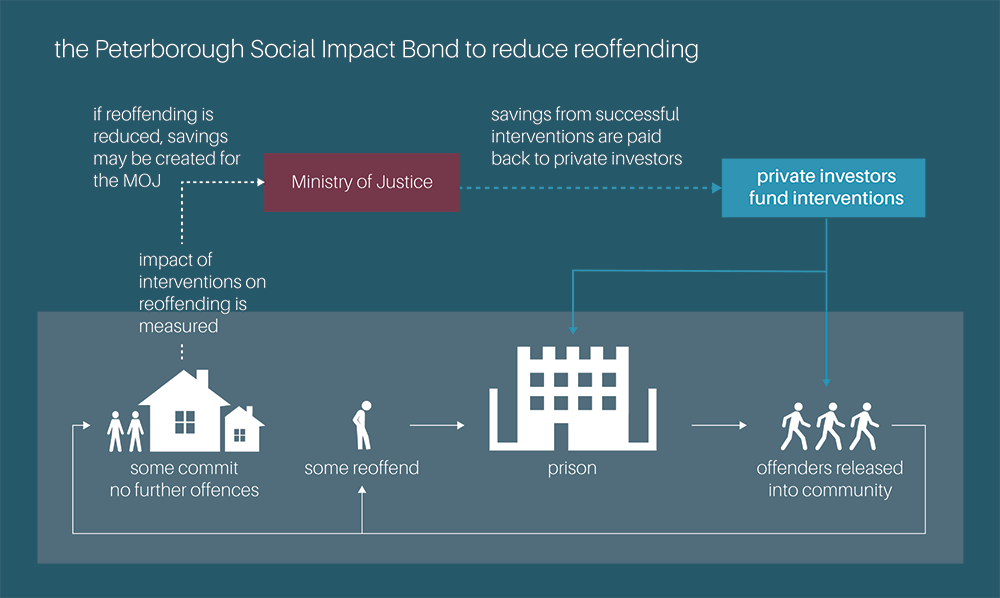

The Peterborough Prison Pilot project was a social finance experiment that created an ad hoc recidivism reduction program – operated by the stakeholders and funded through a social bond issue, which, like any other bond, is simply a financing mechanism to attract private capital by promising a return on investment. The only difference is the nature of the underlying asset.

The scheme centered on privatizing a part of the parole system, offering a service to prisoners on their way out of jail funded by private investors who would receive a return depending on whether or not the service, which in this case was also run by the bondholders, would change the behavior of the inmate to the point that he or she wouldn’t re-offend.

The SIB’s dividend payout was conditioned on a 10% drop in recidivism rates, which was not reached in the first phase of the experiment, according to an independent study. Nevertheless, interested parties like the Rockefeller Foundation gushed at the data, asserting that social finance could provide « meaningful improvement in life outcomes for ex-offenders.”

Marketing hyperbole aside, the pilot actually failed miserably and was cut short two years earlier than anticipated. RAND Europe, which was commissioned by the Ministry of Justice to write up the pilot’s final report, blamed the elimination of the « payment-by-results element » from the project on reforms to probation laws.

Despite these significant shortcomings, Gordon Brown declared the SIB experiment to be a total success in 2017. In an op-ed, Brown takes partial credit for the creation of the SIB as he well should. It was his task force, after all, created during his tenure as chancellor of the exchequer, that got the ball rolling on social impact investment schemes and set the stage for Sir Ronald Cohen to want to aim higher and « address the financial problems of the Middle East » by investing in Palestinian businesses.

Moses’ forgotten son

Sir Ronald’s Zionist credentials are impeccable. Marrying into Israeli royalty on his third go in 1987, Cohen found himself in the center of Israel’s foundational mythologies and its darkest intelligence apparatus. His wife’s late father, Yossi Harel, started out bombing Palestine for the Royal British Airforce during World War II before reserving a place in history as the organizer of a clandestine human trafficking operation in 1947 when he « personally delivered » 24,000 refugees from the Holocaust to Palestine.

Coined as the « Exodus » in honor of the biblical tale, Harel was a field asset of the incipient Israeli intelligence networks, then in gestation on the banks of the Hudson River in New York and elsewhere. He would later become a top commander for Mossad, along with his fellow Haganah operatives who had been working to settle European and Russian Jews in Palestine, an effort that began in 1934 and followed a secret pact between Nazi Germany and the Zionist Congress a year earlier.

Cohen’s links to the most elite circles of Israel’s power structure are undeniable. Just as he was finally moving out of his office at Apax Partners and turning his full attention to « social investment, among other things, » as he told The Guardian at the time, Cohen co-founded a hedge fund called Portland Capital with Lord Jacob Rothschild and Sir Henry Solomon and together took significant stakes in other hedge funds, such as currency specialist Millennium Global.

In 2005, Solomon and Cohen opened an office in Tel Aviv for their Portland Trust, a non-profit organization promoting « peace and stability » in Palestine through “economic development.” By 2013, Portland Trust was « increasingly active in the Palestinian Territories, » designing the « financial infrastructure of the West Bank » through « micro-finance, loan guarantees, and other credit facilities, » according to The National.

Return to Eden

Cohen founded Social Finance Israel (SFI) that same year to start bringing the $1 trillion social finance market to the Middle East in earnest. Social impact bonds for all sorts of community projects are being deployed in and around Israel by SFI and its partners, with SIBs now attached to matters such as « loneliness of the elderly, » math scores of Bedouin children, and preventing diabetes in partnership with UBS.

SFI board member Chemi Peres — founder of Israel’s largest venture capital firm, Pitango, and chairman of his father Shimon Peres’ Center for Peace and Innovation — joined Cohen for a Zoom chat in October 2020 in which they discussed « the magic 10% » or the tipping point at which the percentage of « companies [that] are actively measuring and managing their impact » begins to shift the world economy into a social finance paradigm or « SDG market. »

Israel is a key node in the operation to overhaul the global financial system, as the so-called « Start-up Nation » rolls out one cybersecurity and backdoor tech start-up company after another, many of which are incubated in the IDF’s notorious Unit 8200, which features its own social impact technology accelerator lab known simply as 8200 Impact.

8200 Impact was described as a « market builder » in a country profile of Israel prepared by Sir Ronald Cohen’s Global Steering Group, which was established in 2015 to « continue the work of the Social Impact Investment Taskforce. »

Peres’ Pitango has funded several Unit 8200 companies over the years and is working with Cohen to bring the « magic » number to fruition. « In order for these startups to migrate into the SDG market, » writes Peres in the blog post, « they must blend an impact framework and measurement system within their core business. »

In other words, surveillance and intelligence signals have to be consolidated into the broader economic system they call « social finance » through technologies like 5G and other telecommunications ICT (information communication technology) upgrades. 8200 Impact partner Isaac Benbenisti from Israeli telecom Partner Communications Company Ltd, describes the nature of the opportunity — known colloquially as the « Great Reset” — in a recent interview with CTech:

The basis for the reset concept is the realization that the world is in a financial crisis due to the pandemic, and needs to incorporate equality, empathy, mutual responsibility, and support of weaker populations, not in the name of fairness or to have a clear conscience, but as a necessary condition in order to emerge from the financial crisis. »

Parting of the Revenue Stream

At the core of social finance lies the « smart city » — a technologically connected permanent surveillance and data-analysis hub, which feeds into the ‘trustless’ transaction frameworks like blockchain in order to execute the work of human society.

Cohen is building ten of these cities in Israel, perhaps inspired by the prototypical smart city he lived in as a child in North London, but guided by the same rationalizations expressed by his colleague Benbenisti.

In a recent interview with Yale SOM’s Impact Lab, Cohen sensed that « the winds of change [are] blowing quite strongly now, » adding that the « final piece of the puzzle » was the consumer, arguing for a « radical reimagining of consumers’ right to transparency, » which boils down to little more than advertising.

« Twinings Tea delivers more environmental damage than it does profit, » he states as an example of a consumer’s right to know and how they would use that information to drive the market. But that is at best a simplistic take on the real financial schemes behind social impact bonds and other so-called sustainable development models.

A more apt appraisal would feature The Consolidated Association of the Planters of Louisiana or CAPL for references of social impact investment’s ties to American slavery, which are firm and direct.

The CAPL was a bank formed by Southern plantation owners, who leveraged the « value » of their slaves to create mortgage-backed securities issued by their bank, in order to borrow against them. The scheme would only have worked as a fancy bartering operation for CAPL stakeholders had the state of Louisiana not backed CAPL bonds with $2.5 million worth of public funds, making the slave bank-issued certificates available for trade in the open market.

In the case of Sir Ronald Cohen’s social impact bonds, the slaves are free to roam as long as they heed the prompts and cues emitting from their hyper-connected 5G wearables and other devices all smart-city dwellers will interact with one day.

For Sir Ronald Cohen, that day is coming soon: « The Covid-19 economic crisis appears to be much more serious than the 2008 financial crisis, » he told Global Capital in June 2020, predicting that governments were « going to be very heavily indebted » and that this « crisis has shaken our long-standing habits and beliefs and is opening the door to potentially very important changes. »

Feature photo | Ronald Cohen, chair of a global steering group on social impact investing, attends a news conference in Tel Aviv on March 14, 2016. Baz Ratner | Alamy

Raul Diego is a MintPress News Staff Writer, independent photojournalist, researcher, writer and documentary filmmaker.